Amid hype and race to the top, do new possibilities need new policy thinking?

As 5G moves into (nearly) touching distance for those lucky, early-adopting communities around the world that will see it deployed, there are still overhanging questions as to what success will finally look like.

They are not the only questions: infrastructure costs are already projected to be substantial whilst prospective new services have largely unproven business models. For many, it is not clear that 5G will offer something that cannot already be achieved over 4G.

Achieving the aspirations of 5G, therefore, looks like requiring new thinking and some departures from what has gone before. One departure is already clear: 5G clearly will not be the single, standalone (and invisible) wireless overlay earlier wireless technologies have been.

Instead, this is a technology that is likely to be deeply embedded in the fabric of everyday life for all of us.

Attribution: ericsson.com

Different regions, different views

Defining what form this embedding should take is not clear-cut.

5G has certainly been hyped. Politicians see national prestige and geopolitical power “in winning the race,” service providers see bragging rights particularly in the consumer marketplace, and equipment vendors see more revenues in next-gen sales.

But beyond that, different roadmaps could appear around the world, with different implications, particularly for policymakers.

Asia Pacific seems determined to lead, particularly in enhanced mobile broadband. On the current scorecard, China occupies the pole position in terms of 5G readiness, followed by South Korea, with Japan, following the U.S., in 4th place.

In North America, there is likely to be a strong consumer push in terms of advanced mobile services, and at the same time, 5G might find strong deployment as a point-to-point and point-to-multipoint wireless technology. But politicians and policymakers have been openly fretting that the U.S. will now “lose the lead” and some say policymakers have been stung into action in terms of adequate preparation including spectrum releases.

In Europe, seen to lag, alongside the consumer market, officials seem to be emphatic that vertical applications, in manufacturing, processing and the like, will be extremely important. European policymakers want to see 5G teamed with Industry 4.0 in an all-embracing network “glue” to keep Europe competitive on the world stage.

Jyrki Katainen, Vice President at the European Commission, told a Brussels forum recently: “The digital revolution is picking up speed and we have to be ready to exploit the opportunities it will bring…we are now entering the critical phase where connectivity and AI will permeate all areas of the physical world with profound economic and social effects.”

Globally, the stakes are certainly large. No one doubts that there are geopolitical supremacy emphases involved when it comes to 5G. China’s own program is reportedly targeted at more than 400 million subscribers by 2025, the creation of eight million jobs, and an economic benefit estimated to be around USD 1 trillion. The country has been aggressively making preparations including the clearance of spectrum in the run-up to the expected 2020 5G launch phase.

Attribution: pixabay.com

What’s stopping the party?

Real-world deployment, however, is not so clear-cut. An extensive 5G rollout means meeting real-world issues and several items, particularly in the policy space, are on the checklist.

We informally rated them as 0 (little progress to date) to 5 (problem solved)

Spectrum allocation policy has long been seen as the prerequisite for 5G deployment. Certainly, in the global race to launch 5G, early announcements of spectrum plans and auctions have been regarded as success criteria.

A bright spot is that, although they are at many different stages, regulators seem increasingly confident that enough spectrum of the right kind will be made available for 5G.

Given the importance of spectrum in the leadership stakes, policymakers, particularly in Asia Pacific and Europe, have been fast-acting in preparing bands. China, for example, has all but cleared its spectrum to ensure operator requirements are met.

At Europe’s premier spectrum management gathering last month, Philip Marnick, Head of Spectrum for Ofcom in the U.K., suggested: “Spectrum will not be an inhibitor to 5G deployment.” Other policymakers agree. Branimir Stantchev of the European Commission indicated: “Spectrum [for 5G] is not a problem.” Indeed, in preparation for further developments, regulators are announcing plans to roll out much more, especially in the high-band ranges.

In the U.S., FCC Chairman Ajit Pai says he is tabling more spectrum release with a single auction of three more millimeter-wave spectrum bands—the 37 GHz, 39 GHz, and 47 GHz bands—in the second half of 2019. In view this year are auctions of 28GHz and 24GHz bands.

Rating: 4

Vertical market and enterprise applications could be the much-sought killer app for 5G, essentially extending wireless technology into entirely new areas. They promise much, but can this be delivered? A recent report from industry association GSMA pointed out: “Much of the hype [of 5G] has focussed on consumer applications. However, enterprise is the larger opportunity given the nascent but inexorable digital transformation of large swathes of advanced – and in some cases emerging – economies.”

But vertical market justifications could be tricky. They risk an expensive fragmentation if conditions, mainly policy and business models, are not right. Economies of scale matter here as in consumer markets.

A key barrier remains in the differing regulatory and policy regimes across sectors. Healthcare, automotive, transportation, and energy are very different, not merely within countries, but from country to country.

5G vertical applications inevitably involve IoT implementations too, creating further policy requirements. Smart city developments will probably be the most challenging of all, given so many interlocking requirements, and may mandate new forms of regulatory coordination and intervention. Autonomous and connected-vehicle technology likewise faces critical policy imperatives.

Getting to feasible outcomes may require a long road. Inevitably, there will be substantial demands in privacy and security where vertical markets are involved because vertical markets will likely see a very big rise in the number of IoT/IP enabled devices.

Attribution: pixabay.com

Inevitably, priorities are being set, particularly where the race has become global. The GSMA report noted that China’s own plans see challenges too in domestic cross-sectoral policy coordination. As a result, China may emphasize mobile broadband in its 5G ramp-up. Even so, China’s own giants are partnering with foreign firms to build expertise in areas such as industrial IoT, where Siemens and Alibaba announced a joint venture this month.

Rating: 1

Administrative processes in the policy space could be a headache as well if 5G embeds to the expected degree in the everyday world.

On-the-ground planning and siting are some of the many issues that could come to the fore. Many could prove tricky and some experts fear significant obstacles. Philip Marnick, Head of Spectrum at Ofcom in the U.K., told an industry forum last month, “We need to make the planning rules fit for purpose.”

Both U.S. and European policymakers say they are determined to do this, at least in terms of ensuring public authorities cannot unreasonably block 5G deployment. But this will probably still need to be tested at local jurisdictions in many cases.

The issues may be further entwined as policymakers address the competitive landscape for 5G in their markets in public policy terms. Douglas Jarrett, a partner at U.S. law firm Keller and Heckman specialising in policy and licensing issues and frequent blogger on the respected Beyond Telecom Law blog, told PTC: “Near-term deployments of 5G by AT&T and Verizon are a foregone conclusion. T-Mobile and Sprint maintain their merger is essential to a competitive 5G deployment. However, the wireless industry may be overplaying its hand in arguing state and local governments should have little, if any, discretion in approving 5G siting requests and setting fees to access public infrastructure.”

Attribution: ericsson.com

Rating: 2

Network densification in outdoor spaces, a clear requirement of 5G deployment, needs those administrative rules streamlined, and carries other implications, too.

“The densification of networks is undoubtedly one of the key enablers of the 5G wave and it will deliver the very high capacity networks [we seek]” says Branimir Stantchev of the European Commission. He continues: “There are different estimates about the degree of densification …typically for a dense urban environment it may be a few hundred [cells] per square kilometer. In his view, it is this scale of deployment and mass volume which is the critical difference in the 5G era from previous wireless generations.

But, he acknowledges, barriers exist to small cell deployment at this level including planning consents, which may vary widely at regional or city levels, as well as the need for power and backhaul access to these cells.

Cityscapes are also a factor, says Philip Marnick of Ofcom. “Washington DC and New York have very straight roads and it’s therefore very simple to provide coverage for lamppost networks…European streets are not so straight.” He continues: “If we look today at places like Tokyo, [even] 100m spacing of cell hardware is not very dense [in network terms].”

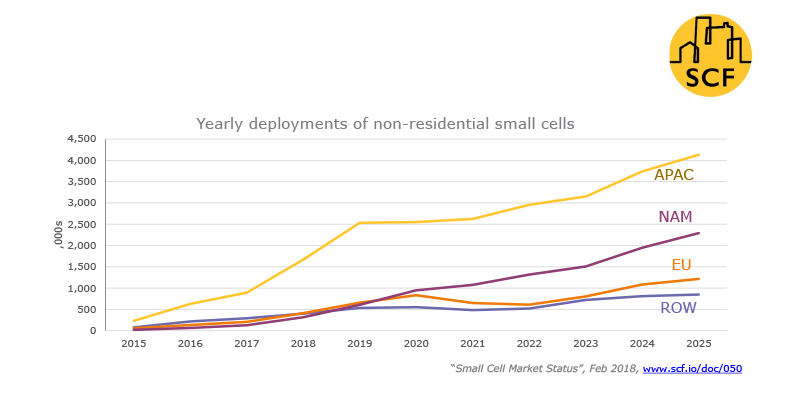

Asia Pacific is strongly benefitting from mass small-cell deployment, supported by extensive fiber networks in key areas, says Mirela Doicu, who chairs the policy working at the Small Cell Forum, an industry body aiming to promote small cell deployment around the world. On present estimates, she says, Asia Pacific is likely to keep its lead in 2025 (see figure).

She says surveys carried out by the Small Cell Forum indicate that mobile network operators list the terms and conditions of operation of such networks, site cost and availability, and site approval as the top three fears they have, and Ms Doicu says the Forum members want to see streamlining and collaboration possibilities in as many cases as possible.

“[The issue] is more than just coverage…it is fundamental to support our cities in order to be competitive,” she affirms. “Small cells are essential building blocks [for the future hyperdense networks we need].”

In the U.S., commentators acknowledge that local, federal, and industry stakeholders will have to work together to achieve desirable outcomes. Around 20 U.S. states were said to have enacted legislation to modernize regulations affecting small cell deployment by last month. Some 89,000 local governments also need to be considered.

Small cells are expected to see relief in many regulatory provisions everywhere. In a seeming race to burn red tape, policymakers are keen to cast a general removal of administrative burdens to 5G, at least the ones under their control. In the U.S., FCC Chairman Pai said last week that he had circulated a “one-touch-make-ready” policy so that telephone poles do not need different crews visiting for different utilities. An order is expected at the FCC’s August meeting to make it “contrary to Federal law for states or localities to put in place moratoria on network buildout.”

Attribution: pixabay.com

European policymakers have similarly said their new Electronic Communications Code explicitly includes mandates for no undue restrictions to deployment, and consistency of measures at national levels.

Rating: 2

In-building demand is a small cell issue closely related to densification, but one that could cause more headaches. Here, 5G finds itself at the junction of regulation, technology, possibly conflicting property rights, and the simple reality of the laws of physics, as the higher band frequencies used in 5G cannot adequately penetrate building fabric.

But demand will almost certainly be there: reliable estimates suggest that 80 percent of current mobile usage is made indoors.

Ofcom’s Philip Marnick points out: “The greatest level of demand today is inside buildings. We need to find solutions. When we talk about small-cell deployments, the small cells that people probably need early are the small cells inside the building.”

Dave Wright, who directs regulatory affairs and standards activities at Ruckus Networks in the U.S., says “[An] outside-in strategy is not going to be effective. We need to find ways of bringing coverage indoors. Existing solutions don’t measure up.”

Here, he says, we need to be creative in business terms. He says “We think that if this is about driving in-building coverage, you have to unlock the opportunity. We need to broaden the ecosystem.” Philip Marnick agrees and suggests one approach may be to allow people to buy their own small cells much as they do with Wi-Fi routers.

There are a variety of scenarios on offer including private networks, carrier-neutral hosts, and spectrum-sharing possibilities, and depending on the attractiveness of the site, mobile operators may want to engage.

Major rollouts of enterprise applications remain qualified, as noted above. Business users will certainly want high-quality 5G coverage in office blocks, but even what this means has been open to debate. Some commentators believe the wireless community, in general, has yet to delve meaningfully into, or, in some cases, even initiate, a debate on the issue. Beyond Telecom Law’s Douglas Jarrett told PTC: “In-building wireless reception challenges are rarely, if ever, mentioned in discussions on 5G deployment in the U.S.”

Attribution: pixabay.com

Rating: 1

Network (and even, spectrum) ownership face interesting questions as a result of policy, business models, enterprise issues, especially if the ecosystem is broadened and people run their own networks, and even more sharply, if new players get access to spectrum usage as Ruckus’ Dave Wright wants.

For the first time, it seems, spectrum usage may not be confined to the traditional mobile network operators. New ideas in spectrum sharing are being rolled out in the US; commentators elsewhere say they are interested in similar moves.

However, regulators will probably want to stay clear of saying who should own what. Ofcom’s Philip Marnick points out, “We don’t know [as regulators] in the world of 5G if the big mobile operators or vertical enterprises will deploy networks…it should not be our job, but the job of the market.”

Rating: 1

Electromagnetic field (EMF) exposure risks remain the acknowledged elephant-in-the-room to the worldwide 5G communities. “There is a big sensitivity about exposure to electromagnetic fields,” says one policymaker. After previous bruising battles, most policymakers see a new round of objections in the 5G era as inevitable.

One complication is that permissible EMF limits, like spectrum allocations themselves, vary from country to country.

To date, however, there seems little policy debate, perhaps not surprising given the number of regulatory issues the 5G world is already facing.

Rating: 0

A new era?

The above ratings suggest much needs to be done. Policymakers themselves admit they are probably facing unprecedented challenges as the 5G, AI, and IoT eras finally arrive. Many acknowledged as much in last week’s premier meeting in Geneva for telecom regulators around the world. Quick-fix, universal solutions, however, seem in short supply, at least for the time being.

Several have emphasized that whatever is done, policymakers will have to ensure they can carry the public with them. Indeed, overt public acceptance of the possibilities of the new technology seems to be vital in promoting success.

In this new era, it seems, we have everything to play for, as a community–and as a society.