Every network must rely on other networks to reach parts of the Internet that it does not itself serve; there is no such thing as a ubiquitous Internet backbone provider.

Here at TeleGeography, our rankings of provider connectivity include analysis based on Border Gateway Protocol (BGP) routing tables. These tables govern how packets are delivered to their destinations across myriad networks as defined by autonomous system numbers (ASNs).

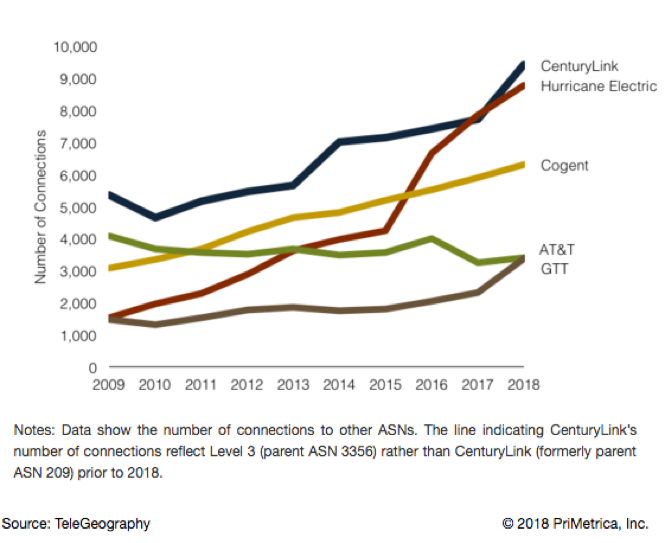

Looking over the last few years of data, we see that mergers and acquisitions have shaped these provider rankings as of late.

Take CenturyLink’s acquisition of Level 3, for example.

This move propelled the combined entity to the top spot as ranked by most metrics. CenturyLink/Level 3 supplanted Hurricane Electric as the provider with the most downstream ASN connections. CenturyLink also boasts the most transit customers in the world.

And GTT’s purchase of Interoute significantly moved GTT upward in the rankings. GTT now serves nearly as many downstream ASNs as AT&T.

Number of Connections for Selected Providers, 2009-2018

Beyond examining overall connectivity, we compared upstream provider connections to downstream broadband ISPs, calculated the top providers to Fortune 500 companies, and examined connectivity to specific industry sectors such as hosting, medical, and finance.

The list of leading providers in the finance sector looks remarkably different from the provider rankings in the ISP/carrier, hosting/cloud, and tech sectors.

Top Upstream Providers of Finance Sector ASNs

| Rank | Provider | Principal ASN | Number of Customers | Percent Reach | Percent Share |

|---|---|---|---|---|---|

| 1 | Century Link | 3356 | 563 | 23% | 17% |

| 2 | Cogent Communications | 174 | 304 | 7% | 3% |

| 3 | AT&T | 7018 | 296 | 10% | 6% |

| 4 | Verizon | 701 | 295 | 16% | 9% |

| 5 | Zayo | 6461 | 159 | 5% | 2% |

| 6 | Crown Castle Fiber (Lightower) | 27506 | 124 | 1% | 1% |

| 7 | Orange | 5511 | 121 | 2% | 1% |

| 8 | Comcast | 7922 | 119 | 2% | 1% |

| 9 | Colt | 8220 | 112 | 7% | 3% |

| 10 | Beeline | 3216 | 109 | 0% | 0% |

| 11 | Cablevision Systems | 6128 | 83 | 0% | 0% |

| 12 | Rostelecom | 12389 | 80 | 0% | 0% |

| 13 | Vodafone | 3209 | 75 | 2% | 1% |

| 14 | Tata Communications | 6453 | 71 | 3% | 1% |

| 15 | Charter Communications (Spectrum) | 20115 | 69 | 1% | 0% |

This sample data comes from TeleGeography’s Global Internet Geography Research Service. This tool provides analysis and statistics on internet capacity and traffic, IP transit pricing, and backbone operators.

AT&T and Verizon ranked highly (third and fourth) among all finance sector companies, while Hurricane Electric didn’t even make the list of top finance sector providers.

Further, the banking industry constitutes to be a sector with often particular networking requirements. This characteristic appears to have given room for market share to certain upstream providers that might otherwise fly below the radar. For example, the northeastern U.S. regional carrier Crown Castle Fiber (Lightower) ranked as the sixth-best-connected provider to the finance sector but only 229th in overall Internet address share.

This content comes from TeleGeography’s Global Internet Geography Research Service. This tool provides analysis and statistics on Internet capacity and traffic, IP transit pricing, and backbone operators.

For more content about all things internet, head over to the TeleGeography Blog.