Co-Authored by Vinay Nagpal and Erick Contag

President, InterGlobix

Executive Chairman, GlobeNet

SUBSEA RESURGENCE & NEW BUSINESS MODELS

The ongoing resurgence of the subsea cable industry, representing upwards of USD 10 trillion in daily transactions over these networks, is more than triple of what the United States spends on health care annually (Source: FCC). Subsea systems are the most important means of global communications.  With the explosive growth of the Internet, a projected CAGR of 40 percent plus, and the ever-increasing generation and consumption of media-rich and machine-to-machine data, we have seen an exponential increase in the amount of data transferred through subsea cable systems. Subsea cables are the foundation of our global communications fabric. Today, the drivers for this growth – and hence leading to major global infrastructure investments – are associated mainly with data center-to-data center (DC-to-DC) traffic.

With the explosive growth of the Internet, a projected CAGR of 40 percent plus, and the ever-increasing generation and consumption of media-rich and machine-to-machine data, we have seen an exponential increase in the amount of data transferred through subsea cable systems. Subsea cables are the foundation of our global communications fabric. Today, the drivers for this growth – and hence leading to major global infrastructure investments – are associated mainly with data center-to-data center (DC-to-DC) traffic.

New investments in large-scale, continent-to-continent submarine cable systems are mainly spearheaded by leading web-scale companies, including OTTs such as Google and Facebook. The need to meet exponential capacity demand, as well as to interconnect data centers with the lowest latency, has led to technology innovation not only in new subsea systems themselves but also in their architecture.

Repeated trans-oceanic subsea cable systems were designed some five years ago with four to six fiber pairs and an average design capacity of some 10Tbps/fiber pair. Newest generation systems are being built with eight, 12, and 16 fiber pairs; and there are clear roadmaps for 24 and perhaps 36 fiber pair systems, aiming to also double the design capacity per fiber pair to 20Tbps/fiber pair or more.

Over the past few years, we have also witnessed a shift in how systems are built. Early systems were designed from one Cable Landing Station (CLS) to the next – a CLS-to-CLS design – where the subsea network met the terrestrial network for onward connectivity. As carrier-neutral city-center POPs emerged, such as the NAP of the Americas in Miami or 60 Hudson Street in New York City, system designs started a POP-to-POP shift.

Today’s trend, however, aims to connect DC-to-DC, in some cases replacing the traditional CLS, with smaller modular CLSs to house Power Feed Equipment (PFE) and push out Subsea Line Terminal Equipment (SLTE) to the data center or a connectivity-rich, carrier-neutral interconnection colocation facility.

As if it were only this simple! Under a joint build project – as favored by several OTTs – you have participants in a subsea cable project with different interests, for example, the DC-to-DC requirement from OTTs with those of carriers aiming to land their cables at carrier-neutral colocation facilities. This leads to new challenges requiring further reviews of subsea cable system architectures and business models.

SUBSEA ECOSYSTEM

SUBSEA ECOSYSTEM

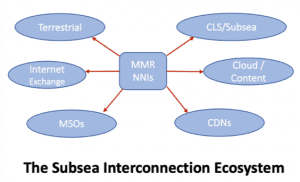

Let’s focus for a minute on the part of a subsea cable system that is built to reach key points of interconnection. The objective is to connect to as many relevant terrestrial carriers and/or services as possible in a highly reliable way on the far end of a subsea cable. While open CLSs can become interconnection points, so can neutral colocation facilities or data centers. It is the ecosystem surrounding a given facility that matters. Today, end-users of international capacity want to access other networks for further connectivity to major markets or to an endpoint; they may want to connect to a Tier-1 IP network or Exchange (IX), have access to diverse terrestrial routes for increased network reliability, CDNs, SD-WAN providers, or connect with cloud aggregation services. The broader the ecosystem the better, as it gives the “customer” a choice of services. Simplicity and clear rules of engagement are key to develop and maintain such an ecosystem.

The landing of subsea cables in a data center is a trend that is continuing to gain traction in multiple geographies around the world, leading to the development of subsea interconnection ecosystems in carrier-neutral data centers. While from a business, operations, and simplicity perspective extending the wet plant to a data center may seem ideal; distance, geographical conditions, regulations, etc., may play a key role in the final system architecture. Terrestrial networks are on average significantly more prone to cuts/external aggressions than well-laid subsea cables, so conceivably the “front-haul” could also be more exposed to outages. Some system developers are hence opting to return to the traditional subsea architecture in search of a more reliable network service, still with their objective to access multiple networks, services, customers, and partners in a carrier-neutral, open-access scalable facility that could either be a modular data center-like facility or a traditional data center.

IS THERE A CLEAR WINNER?

If extending the wet plant to the data center is not ideal or viable, bringing the data center to the CLS is an option to consider. GlobeNet did that in Colombia and expanded their CLS by building a new adjacent Tier III data center facility and will follow similarly with IX services allowing content partners to colocate there and service their customers nationally by easily interconnecting with them at these facilities.

Many developers of new data center scale and hyperscale deployments are not only taking into consideration access to renewable energy, ample connectivity, tax benefits, and other factors to make their location selections, but are now also considering the option to be closer to subsea networks.

Subsea cable landings in existing locations such as Fortaleza, Brazil, or new diverse locations such as Virginia Beach are leading to the development of new ecosystems. Richmond, for example, which used to be a regeneration point for terrestrial fiber networks, is evolving to become a major interconnection hub through the QTS Richmond NAP.

Is the CLS becoming the new “International Edge?” Along this last decade and a half, we went from CLS-to-CLS subsea network designs, via POP-to-POP, to DC-to-DC. While reaching a carrier-neutral, network-rich, and open-access facility would be the aim of a subsea system developer, that may not happen in all cases. We are seeing instances where the CLS becomes the data center, or the data center becomes the CLS. It is an exciting time for our industry, where change is just the norm. Let’s embrace it!