The recent USD 1B investment by the U.K. government and Bharti Global for a 90 percent stake has certainly given a new lease on life to OneWeb. The oldest among the current LEO-HTS plans, OneWeb struggled to raise the remaining USD 2B funds needed to post a USD 3.4B equity raise in the past three to four years. Currently aiming for a curtailed 648 satellite constellation with a total capacity of approximately 1.5 Tbps, the company has come a long way from an outsized consumer strategy to a more B2B enterprise play. The reasons are two-fold:

The recent USD 1B investment by the U.K. government and Bharti Global for a 90 percent stake has certainly given a new lease on life to OneWeb. The oldest among the current LEO-HTS plans, OneWeb struggled to raise the remaining USD 2B funds needed to post a USD 3.4B equity raise in the past three to four years. Currently aiming for a curtailed 648 satellite constellation with a total capacity of approximately 1.5 Tbps, the company has come a long way from an outsized consumer strategy to a more B2B enterprise play. The reasons are two-fold:

- Unavailability of cheap terminals for consumer business. (SpaceX recently touted USD 250 as a ballpark cost.)

- Inefficient architecture (highly elliptical beams – early design) that does not account for ISLs or flexible beams, with small satellites not able to deliver the earlier touted 7 Gbps per satellite.

Manned with a new strategy (Aero-Military-Backhaul-Community Wi-Fi) and a slew of distribution partners (Airtel, Hughes, Talia, and others) built over 2019-20, the company was going strong with 74 satellites launched when the cash crunch hit hard.

Impact From Bankruptcy

Not everyone gets a fresh start and the U.K. government and Bharti Group must feel lucky on unit economics. While the break-even CAPEX cost was assumed to be approximately USD 60/Mbps/Mo before, buying out USD 3.4B of equity at a meager USD 1B improves this break-even CAPEX point to about USD 30-35/Mbps/Mo (NSR estimates). Certainly a write-off for Softbank and Founder Greg Wyler, this deal is a clear win for Bharti (Airtel) and Hughes. Each company put in USD 25M and USD 50M, respectively, in 2015, and have come back with the feeling they only stand to gain from this deal.

While Bharti Global sees this deal as the backbone of its microwave network, serving 425M customers across India and sub-Saharan Africa, simultaneously placing a bet on 5G via satellite, Hughes, with its latest USD 50M investment a month ago, would be looking to solidify its position as a ground segment enabler for a LEO constellation. With almost USD 300M in ground contracts and a critical partner for all Aero-Military-Backhaul-Community Wi-Fi segments, service provisioning in LATAM and other parts of the world, and with a lower wholesale price than before, Hughes could not let this opportunity go.

Airbus too would see this deal favorably, with 574 satellites still to be manufactured at an approximate cost of USD 1M apiece. Continuation of the contract means revenues for Airbus and subsidized manufacturing for OneWeb’s new owners. That brings us to the dark horse in this deal, the U.K. government.

The Role of the U.K. Government

The U.K. government has been touting a £5B proposal for a GNSS replacement to Galileo, which after Brexit, posts an uncertainty over the U.K. government’s ability to access the encrypted M-code GPS signal (military grade) for which the U.K. put in approximately £1.4B as part of a European project. Thus, the OneWeb deal could give the government an opportunity to repurpose 80 of the 648 satellites (at Satcom’s expense) for SAT NAV, a move that has polarized stakeholders.

While many experts believe 80 satellites will not be enough for an independent tracking system (with massive shortage of atomic clocks), they would be enough to build a complementary system to GPS, which might be favorable to the U.S. Department of Defense. Simultaneously, comments from the U.K. Prime Minister and Minister of Science, Research, and Innovation suggest that the U.K.’s investment is part of the mission to build last mile broadband capability and join the first rank of space-faring nations, pioneering in R&D and manufacturing of novel satellite tech via OneWeb.

Thus, the role of SAT NAV has largely been downplayed but not disregarded. Architectures similar to Japan’s Quasi-Zenith Satellite System (QZSS) and India’s IRNSS can provide local GNSS capability with very few satellites, and could be a cheaper fallback option if the OneWeb deal fails to provide a SAT NAV solution. Uncertainty also persists around the fate of Florida’s manufacturing facility and the share of pie that the U.K. government would want in manufacturing for job creation.

What About the Competition?

What About the Competition?

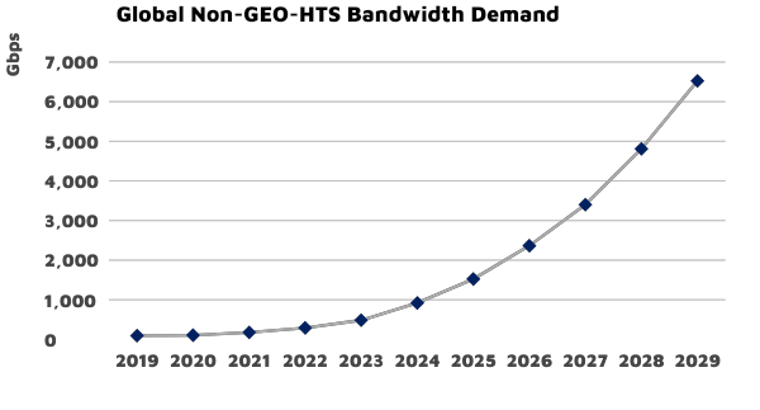

According to NSR’s Global Satellite Capacity Supply and Demand report, the demand for non-GEO-HTS bandwidth is set to skyrocket at 52 percent CAGR to approximately 6.5 Tbps, largely shadowing the latent terrestrial demand for 4G and 5G, along with attractive returns in mobility and military segments. OneWeb is placed in a highly competitive quartet of O3b mPower (SES), Starlink (SpaceX), and Amazon’s Kuiper, and seems to be the least competitive in terms of CAPEX economics even post-bankruptcy relief. SES and Telesat (on paper) by far seem to be the most efficient solutions followed by SpaceX and Amazon’s small-sat LEO architectures. Thus, what OneWeb lacks in technical capability must be compensated in the business and distribution prowess to even start thinking about a positive IRR and replenishment. This is where having partners like Bharti Global and Hughes could mean higher ramp ups in initial years and the right strategy on-ground. While SES has secured approximately USD 1.1B in credits for its MEO constellation and Amazon recently declared a massive USD 10B investment for Kuiper, post its confirmation of 3,236 satellite FCC filing, OneWeb is yet to secure another USD 1.5 to 2B needed to complete its constellation.

Bottom Line

If the venture is able to secure the additional funding, hardware partners seem to be the clear winners (Airbus, Hughes, Arianespace), with a good opportunity for Bharti Group and Hughes (as an SP) to push for LEO services by late 2021 – just in time to compete with SpaceX. While Softbank and other investors have lost money, the new owners would set sights on breaking-even in this business and eventually set sights on a second-generation, more efficient system (CAPEX <USD 10/Mbps/Mo). If the U.K. government manages to sneak out a successful SAT NAV system by repurposing part of the system, that would be a big win on pure cost terms, but that’s a big if. That said, competitors would still aspire to outprice OneWeb in the market, outlining a tough road ahead for the venture.